Unknown top three antimony oxide producer available at less than 5 times EBITDA and 10 times earnings

If you like $UAMY, you will love $CAMB.BR

Campine (CAMB.BR)

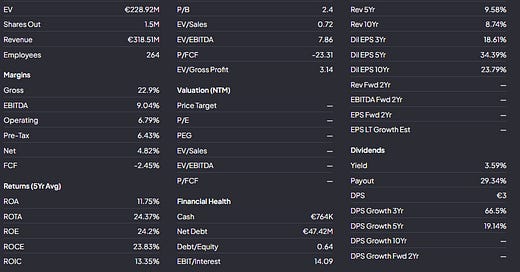

Price: €121 (market cap ~ EV: € 183 million)

Shares outstanding: 1,5 million (Insider ownership: 72%)

Expected EBITDA for 2024 > 40 million - Expected earnings for 2024 > 20 million

In the calculation of the EV Finchat considers the EUR 4,5 million in bank loans, EUR 16 million in overdraft on loans and EUR 26 million in advances on factoring as per June 2024 as debt while the majority portion of those funds are used by Campine for working capital purposes (financing a total of EUR 61 million in inventories and EUR 60 million in accounts receivables against EUR 33 million in payables). From my point of view it is more accurate to consider that Campine’s actual EV is close to its market cap, especially in the context of the surge in profitability over the second half of 2024 and the future normalization of the company’s working capital situation.

Thesis summary:

Founded in 1912, Campine is the 2nd largest lead acid battery recycling company in Europe and the largest producer of antimony trioxide outside of China (top 3 producer worldwide).

The company recycles about 80 to 90.000 tons of batteries from cars, trucks, forklift trucks and powerback-ups per year and about 10.000 ton of other lead waste. It sells about 60.000 ton of lead, 10.000 ton of antimony and 10.000 ton of PET polymer per year. Out of the 10.000 tons of antimony sold annually by Campine, about 1.500 tons are recycled out of the battery recycling business. Campine claims its technology for the recycling of antimony is unique in the world.

With respect to the lead acid recycling business the game changer for Campine was the purchase of certain assets of its French competitor Recylex out of bankruptcy in 2022 for EUR 4,2 million. In the process, Campine bought two battery recycling factories and one plastic recycling factory in northern France with annual revenues of approx. 88 million in 2021. The purchase allows Campine to (1) increase its recycling capacity from 70% to over 90% over the coming years as the French battery breaker sites become supplier of the Belgian lead smelter sites, (2) avoid the construction of a proprietary battery breaker (Campine’s BoD had approved a EUR 25 million budget for this matter) (3) increase the fixed costs coverage as overhead did not grow despite the French expansion and (4) diversify into plastics recycling due to the purchase of the plastic recycling factory.

With respect to the antimony producing side of the business the company benefited in 2024 from the surge in price of antimony from an average of about $12k / ton in 2023 to about $40k / ton as we speak. Antimony supply is considered as critical by the US and the European Union and if you google “why are antimony prices surging” you will find a ton of information on the industry. Antimony trioxide makes plastics and textiles flame retardant and is used in military applications, batteries (EV’s) and photovoltaic equipment. It is produced out of antimony metal, which mainly comes from mining activities in China, Central and Southeast Asia.

With the numbers pre-announced in December the company is trading at less than five times expected EBITDA and less than ten times expected earnings. The question is of course whether current numbers are sustainable, but since Campine is in the process of developing a third generation of antimony recycling that will allow them to recycle up to 50% of its antimony consumption / production by 2027, I’m relatively confident that the best is yet to come. For reference, there is a lot of speculation in a US microcap play on the antimony sector ($UAMY) trading at a market cap of USD 190 million. The company produced 590 tons of antimony in 2023 (compared to Campine producing over 10.000 tons per year), did $9 million in revenues over the first 9 months of 2024 and is loss making.

1. Why does the opportunity exist

Small cap stock (€183 million market cap)

No analyst coverage

The company does limited investor relations efforts - no conference calls or company presentations

The shares are traded on the fixing market, which is the least liquid market of Euronext Brussels because it is reserved for stocks that have less than 2500 trades per year. The trading price is only set twice per day (at 11.30 am and 4.30 pm) via an auction system. The average trading volume is less than €50k / day, which makes the company uninvestable for most fund managers. I only know about one small cap fund that holds 2,6% of the shares (Indépendance Europe Small - Indépendance AM (independance-am.com))

Limited float: only 28% of the shares are traded on the Euronext Brussels exchange as 72% of the company is held by the reference shareholder

2. Company overview

Campine’s business model is to find interesting waste flows and use its proprietary technology to extract resources and contribute to the circular economy. The company employs 270 employees, of which 210 in Belgium and 60 in France (the Recylex activities taken over in 2022). The company’s activities are divided in two business lines, circular metals and specialty chemicals.

Circular metals (129 000 ton / 22.2 million EBITDA in 2023)

Lead – Campine recovers, treats and recycles lead from industrial waste (old roofing, high voltage cables, medical equipment and industrial waste) and produces refined lead ingots.

Metals recovery – Campine recovers metal from industrial waste. It refines lead and antimony in-house to produce new and reusable raw materials, which are onward treated by specialist refining companies.

Recycled batteries – Campine collects and processes used lead acid batteries in three production sites located in Belgium and France.

Specialty chemicals (21 000 ton / 4,6 million EBITDA in 2023)

Antimony trioxide

Flame retardant masterbatches – flame retardants that are dispersed in a polymer matrix or plasticiser

Recycled polymers – Recycled polypropylene compounds are produced by recycling post-production and post-consumer waste. A large selection of the compounds are approved by the main automotive manufacturers and their suppliers.

Some key dates for the company:

- 2017: EU fine (EUR 8,2 million) for alleged violation of competition rules in the market for lead recycling followed by a replacement of the CEO.

- 2018: Start of roll-out of new plan to increase investments in material recovery and recycling activities (expected investment of EUR 25 million over 4 years)

- 2019: EU fine lowered to EUR 4,3 million following Campine’s appeal

- 2021: Campine developed an innovative process to transform antimony containing fractions in industrial waste directly into antimony trioxide.

- 2022: takeover of activities from Recylex for EUR 4,2 million

Circular metals division

In this division the company recycles about 10 million lead acid batteries per year, which makes it the second largest lead acid battery recycling company in Europe (behind Eco-Bat). The advantage of lead-acid batteries is that they have the same composition throughout the world (65 percent of lead and an acid or gel in a plastic casing), which makes it easier to recycle the different components. Every car with a classic combustion engine has one. Before the takeover of Recylex, Campine would simply melt the entire battery in its lead smelter sites, allowing to recycle up to 70% of the battery. The purchase of the battery breakers of Recylex allows Campine to better separate the different parts of the battery (the plastic casing, the metals and acid), improving the recycling rate to 90%.

In the metallurgy market for lead the different participants in general cooperate with each other (buying and selling lead from and to each other), even though market participants are considered competitors. In the production of lead, Campine is the number three in Europe (behind Eco-Bat and Glencore). About 80% of the recycled lead goes back to the production of lead-acid batteries and powerback-ups (85% of all the lead in the world is used in batteries). The remainder is mainly used for medical devices and to make seabed cables heavier. The CEO explained in an interview last year that the lead produced in the division has been sold out every year for the last 10 years. Despite the replacement of classic combustion cars by EVs and the negative perception of lead, the market is still growing 1,5% to 2% per year and is expected to do so until 2030.

The fact that the market is an oligopoly is evidenced by a fine issued by the European Commission in 2017 to Eco-Bat (EUR 32.8 million), Recylex (26,8 million) and Campine (EUR 8,2 million) for alleged violation of competition rules in the market of lead recycling over the period 2009-2012. Johnson Controls (now Clarios) avoided a fine of EUR 38,4 million by revealing the existence of the cartel to the European Commission. Campine’s defense was that it did not actively participate in cartel formation, but was dragged along by one of its customers. Campine got a refund of EUR 3,9 million in appeal in 2019, while the European Commission confirmed the fines for Eco-Bat and Recylex.

In the aftermath of the European Commissions’ fine, Campine’s CEO was fired in 2017 and replaced by the current CEO and Recylex went into bankruptcy in 2020.

In terms of cyclicality it is interesting of note that when lead prices are increasing, the margins of Campine are increasing in general as well. They however negotiated deals with their suppliers that when lead prices are decreasing they are able to pay a lower price for the lead-acid batteries that they use as an input in their production process. At the same time Campine hedges part of the production as well.

Figure 1 Source: from 2023 annual report

Specialty chemicals division

Campine is the third largest antimony trioxide producer in the world, after two Chinese companies and before the French division of $AMG.AS. It produces about 10.000 tons per year on a total worldwide antimony oxide production of slightly over 100.000 tons. Antimony trioxide is produced out of antimony metal, which mainly comes from mining activities in China, Central and Southeast Asia. The product is used in the plastic casing of EV batteries, for military purposes and as a raw material of PET bottles.

Figure 2 Global market share for antimony trioxide. Source: from 2021 annual report

About 15% of Campine's antimony trioxide production comes from antimony recycled from the lead acid batteries used in the circular metals division. The remainder is sourced from antimony miners. In a press release from last August you can see that Campine decreased its dependence from Chinese suppliers to less than 5%. Since the Chinese government issued these restrictions, antimony prices have increased from $24k / ton to about $40k / ton. For reference, until the end of 2020, antimony prices were below $7k / ton (cfr. below graph).

Analysts expect a further growth in demand for antimony of 5% per year for the next 5 years.

Figure 3 Source: from 2023 annual report

The contribution of this division on Campine's result is rather volatile and driven by the evolution in the price of antimony. When antimony prices increased from $6k to $11k /ton in 2021, the division contributed EUR 12,2 in EBITDA to the group results. Due to the price decrease in 2022 the contribution was EUR 6,4 million in EBITDA and due to the volatile market in 2023 the division generated EUR 4,6 million in EBITDA. When antominy prices doubled from $12k per ton to $20k per ton in H1 2024, the division contributed EUR 6 million in EBITDA.

3. Share Structure

The company has a clean share structure with 1,5 million shares outstanding (no options or warrants), of which 72% is owned by the reference shareholder, the Hempel family. The number of shares outstanding has been stable over the last 10 years.

4. Financials

Campine has a clean balance sheet as per June 2024 with EUR 35 million of PP&E and EUR 125 million in current assets (mainly composed of inventory and accounts receivable), against total liabilities of EUR 94 million. Total equity has steadily increased from EUR 35 million in 2019 to EUR 76 million as per June 2024. Revenues are lumpy as could be expected for a cyclical business, but gross profits have gradually increased from EUR 35 million in 2019 to EUR 73 million over the LTM.

Figure 4 Campine’s revenue (left axis) and EBITDA (right axis) evolution since 2019 (2024: expected numbers). Source: author calculations

The EUR 3,9 million reducement of the EU fine is visible in the 2019 financials ( increasing EPS by EUR 2,6). The impact of the Recylex acquisition is visible in the revenue, EBITDA and EPS evolution since 2022. Following the takeover of the Recylex activities, the company recorded a net gain on bargain purchase of EUR 6,5 million in 2022 (EUR 4,3 EPS). Based on the press release from earlier this week I expect about EUR 15 in EPS for 2024.

Figure 5 Campine’s EPS evolution since 2019 (2024: expected numbers). Source: author calculations

Campine pays out 1/3 of its profits in dividends. At the current share price of EUR 121, the expected EUR 15 in EPS for 2024 and EUR 5 dividend leads to a gross dividend yield of 4,13%. The rest of the earnings is reinvested in the business. Based on CEO interviews I understand that investments are planned in the following areas:

- Investments in the former Recylex activities as Recylex had been underinvesting into its activities when it came into financial difficulties

- A second and third production line, each costing about EUR 3 million, for the recycling of antimony trioxide (which should get them from 1.500 tons to 5.000 tons of recycled antimony).

- Investments to add an additional 10.000 ton in lead melting capacity.

- Investments in the area of the recycling of polypropylene (extracting antimony from plastics and textile)

5. Valuation and price target

As referenced in the introduction and thesis summary there is a US microcap play on the antimony sector ($UAMY) that is worth more than Campine. It only produced about 500 tons of antimony oxide in 2023 (compared to Campine producing over 10.000 tons annually) and is loss making. At the same time you have Campine trading at less than 5 times EBITDA and around 8 times earnings. Something has got to give, but I would say that it is a combination of UAMY being overvalued and Campine being somewhat undervalued.

As Campine is still a relatively cyclical company I would currently not pay over EUR 150 / share or 10 times this years earnings. That equates to about 7 times last year's EBITDA and 15 times last year's earnings, when the contribution of the antimony division to the overall results was limited to only EUR 4,6 million in EBITDA.

6. Catalysts

Continued growth in revenues and profitability

M&A

Increased investor relations efforts

Assignment of a liquidity provider or uplisting to a major stock exchange

Campine has even become a bigger player now the Chinese producers are out. I’m expecting a booming year and the third generation of reclycling ATO out of lead batteries will make it even bigger (in proably 2 years Campine will be able to recycle 50% of its ATO-production out of recycling!!)

Latest comments suggest that Campine is in talks with the American government (and we know why…there is no ATO for America but they have 160mln batteries available per year for recycling and need the knowhow of Campine now).

Thank you for bringing this interesting company to my attention.

It has nothing to do with your article but I like their blogposts. I like to think that they show “the human side” of the company.